|

-

01-28-2009, 09:49 AM

#241

Ultimate Member

The term 'Privateer" comes to mind for those doubling profit and return to shareholders.

'Off course'  huge investment is required to maintain and develop infrastructure and supply. huge investment is required to maintain and develop infrastructure and supply.

However, the funds for this are" BORROWED ".

Financed by lnstitutions and Banks with very handsom interest return.

CUSTOMERS, PLAIN AND SIMPLE, WERE OVERCHARGED.

PROFITEERING IT'S CALLED AND IS ILLEGAL.

The Privateer......... nice work if you can get it! ha haaaaaaaargh! matey.

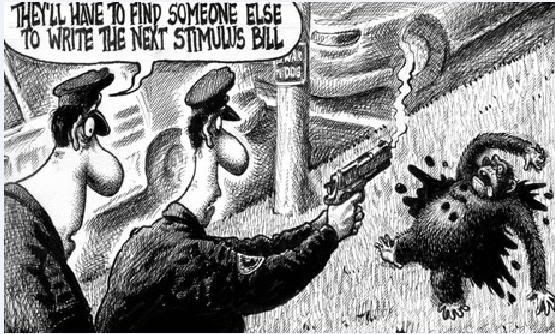

CLICK PIC CLICK PIC

PROFIT IS THEFT - SOMETHING FOR NOTHING

Consumers are happy to reward those providing them worthwhile service.

When this arrangement is abused, as it always is

something has to be done in the name of Justice.

-

01-28-2009, 05:13 PM

#242

Ultimate Member

Extra! Extra! Get yer Bonus here.

"Through complex commercial and stock market operations, as well as falsifications, the the value of shares on the stock market increased, without deposits to back it up, and subsequent sale of the shares profited."

Last edited by herosrest; 01-28-2009 at 05:19 PM.

-

01-29-2009, 11:52 AM

#243

Ultimate Member

-

01-29-2009, 09:40 PM

#244

Ultimate Member

-

01-29-2009, 10:21 PM

#245

Ultimate Member

Calls for oil at $60-$80 a barrel by OPEC. How bad is it going to get?

Backfires! Backfires!

The easiest way there is - pure, simple logic - Let the banks go under.

It will save so much pain. Why delay the inevitable.

What is the point of sorting out Yesterdays problem? Honour amongst thieves, maybe..

Last edited by herosrest; 01-29-2009 at 10:26 PM.

-

01-29-2009, 10:34 PM

#246

Ultimate Member

Mr El Badri agreed: "A $50 price will not allow us to invest.

Gamblers with more money than sense!

Oil has been vastly, obscenely over priced since it was used as a political weapon.

Which was a long time ago. Remember?

Last edited by herosrest; 01-29-2009 at 10:41 PM.

-

01-29-2009, 10:37 PM

#247

Senior Member

Waaah, waaah.......

Thank God we're not getting all of the government we're paying for!

-

01-29-2009, 11:02 PM

#248

Ultimate Member

A considerable number of the brightest and best are currently struggling with the problem of value and valuation. What is a property worth?

Its real actual independant value.

Of course there are market rules and ability to pay apply. Beyond that, however is the cost of replacement - what is the rebuild or lnsurance.

A very real and bankable valuation. Which nobody can deny. Which nobody can deny. For he's a..............

Last edited by herosrest; 01-29-2009 at 11:11 PM.

-

01-29-2009, 11:16 PM

#249

Ultimate Member

Last edited by herosrest; 01-29-2009 at 11:20 PM.

-

01-29-2009, 11:23 PM

#250

Ultimate Member

Topic Terminated. 11-30-2004 to 01-30-2009.

-

02-25-2009, 08:39 AM

#251

Ultimate Member

Sharks harpooning Whales! - enough of this rubbish!

"We all felt at home among the sharks and stingrays,"

A crew - a motely crew - got together in insurance some years back - they are scattered to the 4 corners of the planet -

raising chaos and financial mayhem.

They all worked one place - one theme - one practice.

Originally Posted by herosrest

Traders..... deal makers, the Barrow Boys - have got their hands on the property market and are raping it.

They will tell you all day long that those fins on their back are an illusion and get away with it.

Sharks are harpooning whales.

How do you think the Hedge Funds are turning those pretty pennies.

It ain't the TAX dodges doing it.

People sign up for 25 years for this rubbish.. no funckin WAY! Lock them up! - with Insurance rebuild values.

Originally Posted by herosrest

Originally Posted by herosrest

Click pic Deficits could rise sharply if radical new proposals about the way pension fund assets and liabilities are calculated and reported are adopted. The Accounting Standards Board (ASB) is responsible for the rules which govern financial accounting. Click pic Deficits could rise sharply if radical new proposals about the way pension fund assets and liabilities are calculated and reported are adopted. The Accounting Standards Board (ASB) is responsible for the rules which govern financial accounting.

Originally Posted by herosrest

"Investor SRM Master Global Fund Ltd., which bought a 5.19% holding in the Countrywide Financial Corp on Jan. 24, said Thursday in a filing to the U.S. Securities and Exchange Commission that the agreement did not “provide sufficient value” to Countrywide's common... "

- Nov 28, 2007 Reuters.uk,In a regulatory filing, SRM, run by influential former UBS trader Jon Wood, said it had bought another 2.5 million shares at 114.7 pence each.

LONDON (Thomson Financial) - SRM Global Master Fund Ltd Partners, the hedge fund seeking to stop the auction of Northern Rock PLC, has raised its stake in the stricken UK mortgage lender to 9.29 pct from 9.1 pct.

SRM, led by former UBS trader Jon Wood, said in a statement that it bought a further 800,000 Northern Rock shares at 0.929459 per unit, taking its total holding to about 39.143 mln shares.

Originally Posted by herosrest

21 December 2007, 18:29 GMT

Northern Rock has agreed to hold an emergency meeting for shareholders to discuss its sale process on 15 January. The meeting will be the first high-profile occasion for shareholders to grill management after the bank ran into trouble in September. Two of the bank's major shareholders are calling for restrictions on the bank's ability to sell the company's assets or issue new shares.

http://www.hedgefundreader.com/2006/...obal_read.html Investors in SRM Global can choose from two fee structures – a 1 percent management fee to invest for a period of five years and 1.5 percent for three years. SRM Global will retain 25 percent of its profits.

http://www.telegraph.co.uk/money/mai.../ccdiary12.xml Hedge fund RAB Capital spared no expense when it came to organising this year's Christmas party: hiring out the London aquarium for drinks, dinner and dancing. "We all felt at home among the sharks and stingrays," jokes my man at RAB, who tells me the party continued at a Mayfair club.

Hang on a mo... NR got into trouble with a high risk strategy that Hedge funds exploited. Funny old world. Sharks harpooning whales. whatever next?

Originally Posted by herosrest

What's the odds there is an equal amount of loss - sitting in books somewhere.......... bonds maybe........

Originally Posted by herosrest

C0-INCIDENCE BEING RARER THAN TRUTH DURING THIS 21ST CENTURY

is it not oddity sublime that slap bang in the murdiddle of the worlds largest EVER Ponzi HaHa! scheme

that a renowned Banking World presence half a globe away manages to write off the exact same amount of troubles.

Well balanced them Swiss are. Very well balanced.

Senior UBS executives and board members may come under pressure to hand back Sfr60m (£32m) in bonuses paid out last year.

The Swiss bank said today that the issue of executive remuneration, including whether previously granted incentive awards will be repaid,

will be discussed at an extraordinary meeting for shareholders scheduled for November 27.

However, bank insiders denied that anyone will be forced to hand back a bonus that they have already received.

The bank, the worst European casualty of the 14-month-old financial crisis, writing down $50bn (£31bn),

has already indicated that it will not pay any bonuses this year to Peter Kurer, its chairman, and other executives.

Originally Posted by herosrest

Traders..... deal makers, the Barrow Boys - have got their hands on the property market and are raping it.

They will tell you all day long that those fins on their back are an illusion and get away with it.

Sharks are harpooning whales.

How do you think the Hedge Funds are turning those pretty pennies.

It ain't the TAX dodges doing it.

People sign up for 25 years for this rubbish.. no funckin WAY! Lock them up! - with Insurance rebuild values.

Sharks harpooning Whales! - enough of this rubbish!

"We all felt at home among the sharks and stingrays,"

-

02-25-2009, 08:43 AM

#252

Registered User

quarter pounder with cheese. hold the pickles and onions

-

02-25-2009, 08:52 AM

#253

Registered User

Hero, calm down. Have a seat.

-

02-25-2009, 08:57 AM

#254

Ultimate Member

It will all be crashed so these morons can get out from under and walk away heads held high.

-

02-25-2009, 08:58 AM

#255

Registered User

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

huge investment is required to maintain and develop infrastructure and supply.

CLICK PIC

Reply With Quote

Reply With Quote

The process has been and remains under ABUSE!

The process has been and remains under ABUSE!